Home

Budgeting on Mintyn Digital Bank

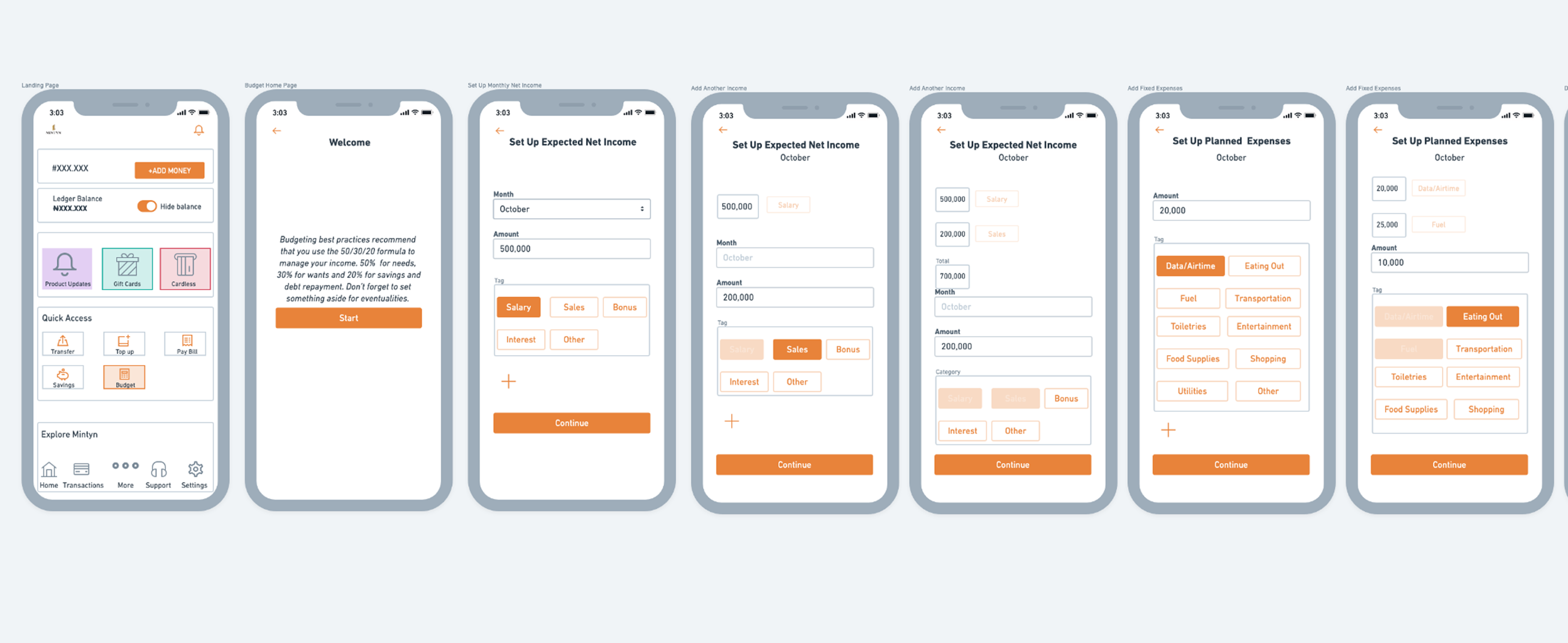

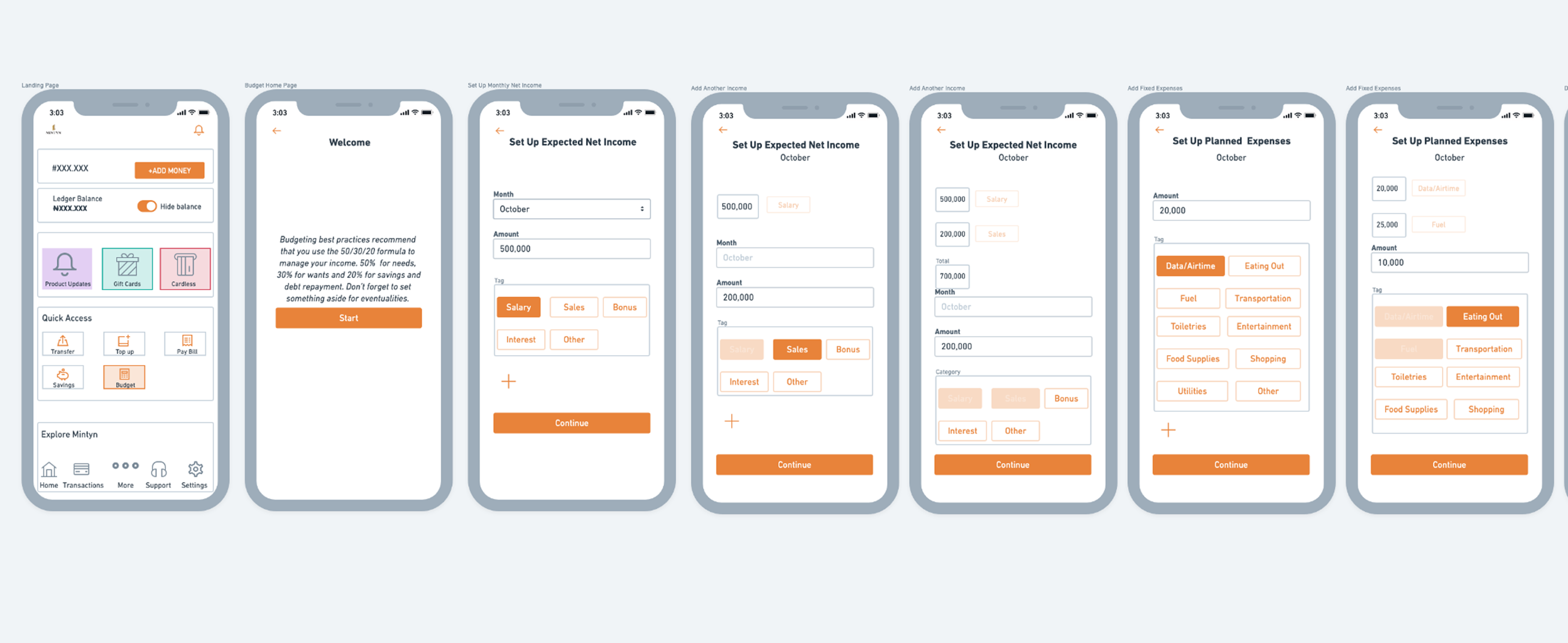

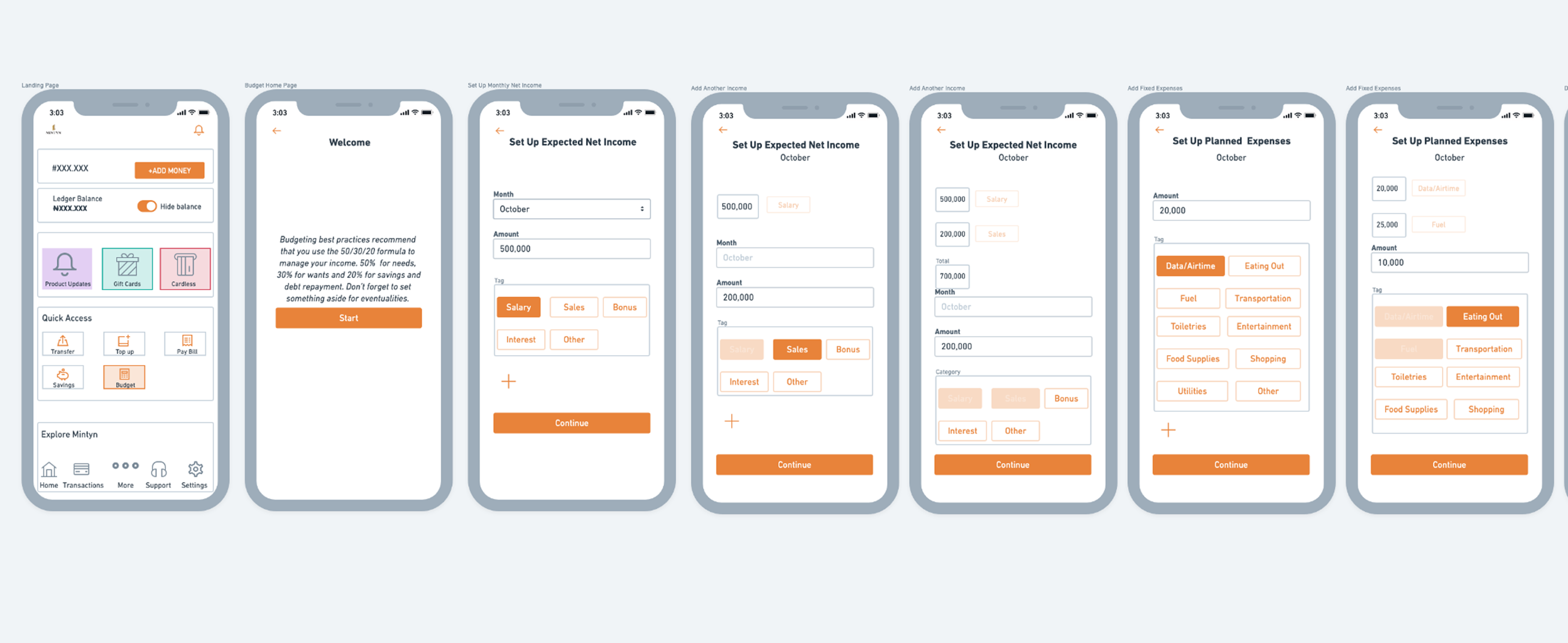

As a solo designer, I contributed to the implementation of the budgeting feature in the by conducting user research, creating intuitive information architecture and user flows, and designing visually appealing interfaces. I also conducted usability test and iterated on the design based on user feedback.

Background

Mintyn is best known as a digital bank, but also builds digital products for industries beyond fintech. I joined on a 6-month contract to design a telemedicine app (delivered in 2 months), then spent the remaining time helping the team ship new features to improve user engagement.

To guide what to build next, we surveyed over 15,000 active users via in-app and email prompts. Our goal was to identify high-impact features that aligned with real user needs and would improve engagement. We presented four feature options: Budgeting, WebPay, Split Payment, and Business Registration.

Budgeting was the clear favorite. Users wanted tools to track spending, set goals, and manage money all inside the app. So we got to work.

UX Research: Understanding how our customers budget

Before designing anything, we needed a clearer picture of how our users managed their finances. We conducted another survey to collect users income and expense entries.

To dive deeper, we ran a focus group with 12 users to better understand budgeting habits, preferences, and frustrations.

Insights gathered:

Users valued having predefined income and expense categories that reflected their actual financial behavior.

Budgeting frequency varied. Some users preferred weekly, quarterly, or yearly options over a strict monthly cycle. We designed with this flexibility in mind.

Many 8 out of 12 desires to name their budgets, making them feel more intentional and tied to personal goals. We added this as a core feature.

Building a budgeting tool that adapts to users needs

With these insights in mind, we started designing an intuitive budgeting flow.

Predefined income & expense categories: Based on our survey results, we created easy-to-select options that matched user behaviors.

Flexible budgeting options: Users could set a budget not just for a month, but for weeks, quarters, or a full year.

Personalized budgets: Users could name their budgets, making them feel more intentional and customized.

Once we had our initial prototype, we took it back to our users.

Testing & Iteration: Refining for control and personalization

We created a focus group of 10 real users and gave them the prototype to test. One user noted, "Naming my budget made it feel like a goal I actually want to achieve," while another appreciated the ease of switching between weekly and monthly budgeting.

Their feedback was clear:

Their feedback was clear:

Users appreciated the predefined categories and personalized naming options, as it made budgeting easier to start and more meaningful.

8 out of 10 requested even greater flexibility in setting custom timeframes for budgets, not just monthly options which validated our earlier decision to support weekly, quarterly, and yearly budgeting.

6 out of 10 users mistakenly reselected categories they had already chosen. We resolved this by updating the UI to clearly show selected categories as disabled.

One key improvement request was clearer guidance during budget creation, so we refined the UI to better support empty states and user tips.

These refinements helped shape a more dynamic and user-friendly experience, which we brought into development for further enhancement.

Final Iteration: Making budgeting even more seamless

We ran another test with our focus group using the app in a staging environment. One major request emerged, users wanted to import their Mintyn transactions and automatically categorize them during budget creation.

While this request was outside our original scope, it was intuitive, aligned with user needs, and directly supported our goal of keeping users engaged. So we went back to design and added transaction import to the flow.

This addition was a game-changer. Instead of manually entering past transactions, users could now:

Import their banking transactions directly into their budget.

Map them to expense categories automatically, making budgeting effortless.

Outcome

Following launch, we saw a 28% increase in weekly active users engaging with the budgeting feature within the first month. User feedback highlighted the ease of use and the satisfaction of setting flexible, personalized budgets.

One user shared, "Being able to import transactions and see where my money goes changed the way I manage my finances.”

With the final refinements in place, Mintyn’s budgeting feature launched, offering:

A flexible budgeting system that adapts to different financial needs.

Predefined and customizable categories to make expense tracking easy.

Transaction importing for automated budgeting, reducing manual work.

Final thought

This project was more than just adding a new feature, it was about listening to users and building something they truly wanted. By starting with direct user feedback, iterating based on real-world usage, and continuously refining the experience, we created a budgeting tool that didn’t just track money it kept users engaged with the Mintyn app.

Nathaniel Ajulopin

+2349038174098

ajuloopind@gmail.com

Home

Budgeting on Mintyn Digital Bank

As a solo designer, I contributed to the implementation of the budgeting feature in the by conducting user research, creating intuitive information architecture and user flows, and designing visually appealing interfaces. I also conducted usability test and iterated on the design based on user feedback.

Background

Mintyn is best known as a digital bank, but also builds digital products for industries beyond fintech. I joined on a 6-month contract to design a telemedicine app (delivered in 2 months), then spent the remaining time helping the team ship new features to improve user engagement.

To guide what to build next, we surveyed over 15,000 active users via in-app and email prompts. Our goal was to identify high-impact features that aligned with real user needs and would improve engagement. We presented four feature options: Budgeting, WebPay, Split Payment, and Business Registration.

Budgeting was the clear favorite. Users wanted tools to track spending, set goals, and manage money all inside the app. So we got to work.

UX Research: Understanding how our customers budget

Before designing anything, we needed a clearer picture of how our users managed their finances. We conducted another survey to collect users income and expense entries.

To dive deeper, we ran a focus group with 12 users to better understand budgeting habits, preferences, and frustrations.

Insights gathered:

Users valued having predefined income and expense categories that reflected their actual financial behavior.

Budgeting frequency varied. Some users preferred weekly, quarterly, or yearly options over a strict monthly cycle. We designed with this flexibility in mind.

Many 8 out of 12 desires to name their budgets, making them feel more intentional and tied to personal goals. We added this as a core feature.

Building a budgeting tool that adapts to users needs

With these insights in mind, we started designing an intuitive budgeting flow.

Predefined income & expense categories: Based on our survey results, we created easy-to-select options that matched user behaviors.

Flexible budgeting options: Users could set a budget not just for a month, but for weeks, quarters, or a full year.

Personalized budgets: Users could name their budgets, making them feel more intentional and customized.

Once we had our initial prototype, we took it back to our users.

Testing & Iteration: Refining for control and personalization

We created a focus group of 10 real users and gave them the prototype to test. One user noted, "Naming my budget made it feel like a goal I actually want to achieve," while another appreciated the ease of switching between weekly and monthly budgeting.

Their feedback was clear:

Their feedback was clear:

Users appreciated the predefined categories and personalized naming options, as it made budgeting easier to start and more meaningful.

8 out of 10 requested even greater flexibility in setting custom timeframes for budgets, not just monthly options which validated our earlier decision to support weekly, quarterly, and yearly budgeting.

6 out of 10 users mistakenly reselected categories they had already chosen. We resolved this by updating the UI to clearly show selected categories as disabled.

One key improvement request was clearer guidance during budget creation, so we refined the UI to better support empty states and user tips.

These refinements helped shape a more dynamic and user-friendly experience, which we brought into development for further enhancement.

Final Iteration: Making budgeting even more seamless

We ran another test with our focus group using the app in a staging environment. One major request emerged, users wanted to import their Mintyn transactions and automatically categorize them during budget creation.

While this request was outside our original scope, it was intuitive, aligned with user needs, and directly supported our goal of keeping users engaged. So we went back to design and added transaction import to the flow.

This addition was a game-changer. Instead of manually entering past transactions, users could now:

Import their banking transactions directly into their budget.

Map them to expense categories automatically, making budgeting effortless.

Outcome

Following launch, we saw a 28% increase in weekly active users engaging with the budgeting feature within the first month. User feedback highlighted the ease of use and the satisfaction of setting flexible, personalized budgets.

One user shared, "Being able to import transactions and see where my money goes changed the way I manage my finances.”

With the final refinements in place, Mintyn’s budgeting feature launched, offering:

A flexible budgeting system that adapts to different financial needs.

Predefined and customizable categories to make expense tracking easy.

Transaction importing for automated budgeting, reducing manual work.

Final thought

This project was more than just adding a new feature, it was about listening to users and building something they truly wanted. By starting with direct user feedback, iterating based on real-world usage, and continuously refining the experience, we created a budgeting tool that didn’t just track money it kept users engaged with the Mintyn app.

Nathaniel Ajulopin

+2349038174098

ajuloopind@gmail.com

Home

Budgeting on Mintyn Digital Bank

As a solo designer, I contributed to the implementation of the budgeting feature in the by conducting user research, creating intuitive information architecture and user flows, and designing visually appealing interfaces. I also conducted usability test and iterated on the design based on user feedback.

Background

Mintyn is best known as a digital bank, but also builds digital products for industries beyond fintech. I joined on a 6-month contract to design a telemedicine app (delivered in 2 months), then spent the remaining time helping the team ship new features to improve user engagement.

To guide what to build next, we surveyed over 15,000 active users via in-app and email prompts. Our goal was to identify high-impact features that aligned with real user needs and would improve engagement. We presented four feature options: Budgeting, WebPay, Split Payment, and Business Registration.

Budgeting was the clear favorite. Users wanted tools to track spending, set goals, and manage money all inside the app. So we got to work.

UX Research: Understanding how our customers budget

Before designing anything, we needed a clearer picture of how our users managed their finances. We conducted another survey to collect users income and expense entries.

To dive deeper, we ran a focus group with 12 users to better understand budgeting habits, preferences, and frustrations.

Insights gathered:

Users valued having predefined income and expense categories that reflected their actual financial behavior.

Budgeting frequency varied. Some users preferred weekly, quarterly, or yearly options over a strict monthly cycle. We designed with this flexibility in mind.

Many 8 out of 12 desires to name their budgets, making them feel more intentional and tied to personal goals. We added this as a core feature.

Building a budgeting tool that adapts to users needs

With these insights in mind, we started designing an intuitive budgeting flow.

Predefined income & expense categories: Based on our survey results, we created easy-to-select options that matched user behaviors.

Flexible budgeting options: Users could set a budget not just for a month, but for weeks, quarters, or a full year.

Personalized budgets: Users could name their budgets, making them feel more intentional and customized.

Once we had our initial prototype, we took it back to our users.

Testing & Iteration: Refining for control and personalization

We tested our initial prototype with a focus group of 10 users. Their feedback reinforced key insights from earlier research but also introduced new usability ideas:

Their feedback was clear:

Users appreciated the predefined categories and personalized naming options, as it made budgeting easier to start and more meaningful.

8 out of 10 requested even greater flexibility in setting custom timeframes for budgets, not just weekly, monthly, quarterly, and yearly budgeting.

6 out of 10 users mistakenly reselected categories they had already chosen. We resolved this by updating the UI to clearly show selected categories as disabled.

One key improvement request was clearer guidance during budget creation, so we refined the UI to better support empty states and user tips.

These refinements helped shape a more dynamic and user-friendly experience, which we brought into development for further enhancement.

Final Iteration: Making budgeting even more seamless

We ran another test with our focus group using the app in a staging environment. One major request emerged, users wanted to import their Mintyn transactions and automatically categorize them during budget creation.

While this request was outside our original scope, it was intuitive, aligned with user needs, and directly supported our goal of keeping users engaged. So we went back to design and added transaction import to the flow.

This addition was a game-changer. Instead of manually entering past transactions, users could now:

Import their banking transactions directly into their budget.

Map them to expense categories automatically, making budgeting effortless.

Outcome

Following launch, we saw a 28% increase in weekly active users engaging with the budgeting feature within the first month. User feedback highlighted the ease of use and the satisfaction of setting flexible, personalized budgets.

One user shared, "Being able to import transactions and see where my money goes changed the way I manage my finances.”

With the final refinements in place, Mintyn’s budgeting feature launched, offering:

A flexible budgeting system that adapts to different financial needs.

Predefined and customizable categories to make expense tracking easy.

Transaction importing for automated budgeting, reducing manual work.

Final thought

This project was more than just adding a new feature, it was about listening to users and building something they truly wanted. By starting with direct user feedback, iterating based on real-world usage, and continuously refining the experience, we created a budgeting tool that didn’t just track money it kept users engaged with the Mintyn app.

Nathaniel Ajulopin

+2349038174098

ajuloopind@gmail.com